Celebrating a Milestone: Overwrite's Journey Through 100 Loans

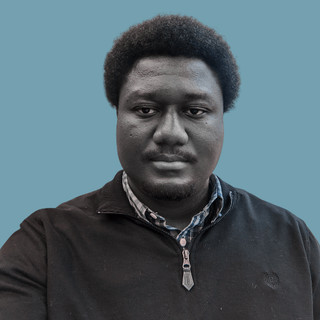

- Nosa Iyare

- Dec 19, 2023

- 6 min read

Disclaimer: The insights shared in this blog post are based on our experience in underwriting 100 (mostly small business) loans. These observations may not necessarily reflect the broader industry trends. We welcome insights from others in the CDFI sector – please feel free to reach out to me at nosa@overwriteinc.com with your experiences.

An unconventional beginning

It's with a blend of pride and candid openness that I reflect on the story of Overwrite's inception – a company that, quite unexpectedly, came to life from a serendipitous twist in my career. As a former loan underwriter and banker, I never envisioned that a simple contracting job with a past employer would be the spark that ignited the creation of Overwrite. Yet, here we are, sixteen months down the line, commemorating not just our first full year in business, but a remarkable milestone: the underwriting of our 100th loan.

As we pause to celebrate this significant milestone, we also take this opportunity to reflect and share some of the invaluable insights we've gathered along the way. These observations and lessons, drawn from our hands-on experience in CDFI underwriting, shed light on the complexities and transformations within our sector. Remember, the insights in this blog post are not just our story but a narrative of the industry's ongoing evolution. With each loan we've underwritten, we've gathered pieces of a larger puzzle, helping us understand and navigate the intricate world of community development financing. So, join us as we delve into the lessons learned from our first 100 loans – a journey that's been as enlightening as it has been rewarding.

Our Observations

1. A Shift from Microlending

A noticeable trend is the move away from microloans by many CDFIs. The realization that small loans can be expensive to originate and service has most likely prompted this shift. Larger CDFIs are also looking to deploy more capital in the competitive lending space and smaller loans may not necessarily move the needle in this regard.

2. Technology's Growing Influence

CDFIs are increasingly embracing technology across various stages, from intake and underwriting to disbursement and servicing. This is obviously to enhance operational efficiency (amongst other things).

3. Focus on Financial Metrics

While financial and banking best practices remain prevalent in the CDFI industry, we notice a lesser focus on social impact metrics. As the CDFI industry gets larger and more ‘professionalized’, perhaps it is easier to measure and communicate financial metrics to funders and other stakeholders. Of course, when underwriting you are mostly exposed to the financial aspects of a business/loan and this may inform our perspective on this matter.

4. The Rise of CDFI Consultants

Post-pandemic, there's been greater awareness and use of CDFI consultants. Unlike in the early days, I find myself explaining less about what an underwriting consultant can do for a CDFI. Consultants are also becoming more niche in the services they provide and markets they service. At Overwrite, we are trying to build a company that supports the operational teams of economic development organizations. We may have started with underwriting but are excited about solving many more problems for the industry in the future.

5. Communication as a Key to Success

Effective communication is important in preventing loans from going bad. Whether communication internally between the lending and portfolio management teams or even while communicating with the borrower, there needs to be a buy-in by everyone within an organization to see success.

6. Longer Loan Terms

We've noticed a trend towards considering longer-term loans, beyond the typical 5-years or less. We are not exactly sure why this is the case but in our experience, CDFIs are becoming open to lending beyond a 5-year term.

7. The Challenges with Collateral

Collateral has always been a major hurdle in the quest to democratize access to capital. Valuing and perfecting non-property collateral remains a significant challenge due to its time and cost implications. Some CDFIs tend to use ‘phantom collateral’. This is when collateral information is retrieved from the borrower but the CDFI doesn’t process/perfect said collateral. It serves more as a ‘psychological safeguard’.

8. Increasing Popularity of CDFIs

Although the CDFI industry has always had a marketing problem, this is slowly starting to change. More and more borrowers are getting informed and becoming savvy when applying to CDFIs. It is not unusual nowadays to see borrowers package their loan applications to highlight the social impact, rural/minority certification status, and even customer testimonials. It is almost as if borrowers are starting to understand CDFI incentives and are doing their best to put their businesses in the best light.

9. The Complexities of Document Management

Document gathering, sorting, storage, communication, and analysis continue to be major challenges in the underwriting process. Some CDFIs are starting to think of creative ways to manage this by providing alternatives to almost every document required during the loan application or intake stage. Other CDFIs are leveraging technology and some are employing the 'fast food' strategy in document management (limited, simple, and popular menus only).

10. The Role of Organizational Culture in Underwriting

While loan policies exist in almost every CDFI, the 'spirit of the organization' often plays a crucial role in decision-making. Experienced staff within CDFIs tend to have tribal knowledge for more nuanced underwriting. This tribal knowledge is often very valuable but unfortunately not documented or formally incorporated within the underwriting process. The beauty of a company like Overwrite is that during the course of our work, we've seen and learned a thing or two from various organizations.

11. Varied Industry Standards

The lack of standardized metrics across the CDFI industry is evident. Even in simple measurements like Debt Service Coverage, different lenders tend to have different interpretations of what it means. While we understand that every organization is different and the market they serve and their risk appetite mostly inform these metrics/standards, CDFIs need to remember their 'why' and update metrics to better reflect their needs today.

12. The Prolonged Loan Process

Despite better and more efficient underwriting, the overall loan process, from application to disbursement, can be lengthy. According to the CDFI fund, 7-56 days is the amount of time it takes to close a loan in the industry. Some transactions even take longer. Unfortunately, speed continues to be a major reason why borrowers get frustrated with the industry and seek out alternatives like payday lenders.

13. The Reliance on Traditional Underwriting Models

Innovation in underwriting seems limited, with a continued reliance on traditional models like the 5Cs of credit. The process to determine credit worthiness has not changed much in over 100 years and most CDFIs tend to stick with the program. While a few CDFIs are becoming open to innovations like cash flow and ai-assisted underwriting, the way loans are being underwritten has mostly stayed the same.

14. The Indispensable Role of MS Excel

Humorously, if Microsoft were ever to discontinue MS Excel, it might dampen the lending operations for most CDFIs. While Overwrite like other industry participants rely on this tool, we are also constantly researching/testing and are open to innovative new solutions that make underwriting faster, cheaper, and better.

15. Credit Training

Formal credit training is lacking with most CDFIs. Back in the day, a lot of banks had dedicated credit training programs and even in that industry, it is becoming less popular. Overwrite may be pioneering training modules for new and experienced underwriters, non-lending team members as well as credit committee members. This training will be specifically tailored to CDFIs. If interested, individuals can reach out for more information at nosa@overwriteinc.com.

Conclusion

Despite limited resources, the CDFI industry continues to play a crucial role in transforming communities. This journey of underwriting 100 loans has been enlightening, and we feel privileged to have contributed to the industry in our little way. Here's to the next 100 loans, and many more beyond that. Remember, your experiences and observations matter – let's continue the conversation. We’d like to know what trends you’ve noticed at your organization. Feel free to email me at nosa@overwriteinc.com. Together, we can drive impactful change in the communities we serve.

About Overwrite

Overwrite is a firm that provides outsourced underwriting, technical assistance and consulting services to Community Development Financial Institutions (CDFIs), Credit Unions & and Economic Development Organizations. Our sweet spot is working for small to mid-sized CDFIs with <$50m in assets. Please reach out to inquire about our services here. You can also email us at info@overwriteinc.com

Comments