The history & future of credit underwriting

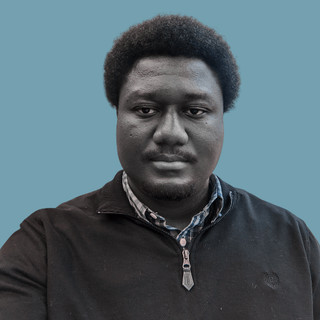

- Nosa Iyare

- Feb 27, 2023

- 4 min read

Updated: Aug 10, 2023

The word "underwrite" comes from the old English word "underwritan" which means "to write under." The word originally referred to the act of signing one's name at the bottom of a document, typically a contract or agreement. Over time, the meaning of the word evolved to include the act of financially supporting or guaranteeing something, such as a loan or insurance policy. In the lending industry, an underwriter is a person that assesses the risk of issuing a loan by evaluating the applicant and determining the terms and conditions of the loan.

Past

The practice of underwriting has a long history, dating back to ancient civilizations. In ancient Greece and Rome, merchants would pool their resources to fund the voyages of traders and merchants, with each participant assuming a portion of the risk. This practice was known as "bottomry" and the merchants who participated were known as "underwriters". In the Middle Ages, the practice of underwriting continued to evolve as merchants formed partnerships to fund voyages and trade. In the 17th and 18th centuries, underwriting began to be used in the field of insurance, with companies and individuals assuming the risk of insuring ships and cargo against loss. In the 19th century, underwriting became a key component of the securities market. Investment banks and other financial institutions would underwrite the issuance of stocks and bonds, assuming the risk of selling the securities to investors. Due to underwriting being associated with assessing risk, the term started being used in lending as well. Banks and other non-bank financial institutions would term the processes of assessing loan risk ‘credit underwriting’ or ‘loan underwriting’.

Present

The loan underwriting process has been modernized and automated mostly through technology, but the fundamental concept remains the same, which is to evaluate the risk of issuing a loan. Banks, Credit Unions and CDFIs hire and train underwriters whose job it is to evaluate loan applications and recommend if they should be approved or declined. These underwriters often use various digital tools to make their work more efficient. The extent to which technology is used in underwriting depends on many factors.

- For standardized loan products like credit cards, car loans, lines of credit and even mortgages, the underwriting process can be fully automated because loan applications are relatively homogenous with standard metrics being evaluated for most borrowers.

- For commercial loans, lenders may use a half-and-half approach where a human underwriter uses digital tools and online platforms to enhance their underwriting efficiency and precision. These digital tools make the underwriting process faster and more convenient for borrowers, with the use of digital identification, digital document management and electronic signatures to name a few.

- Microfinance and small business loans may require more of a white glove approach in order to understand the individual need of each borrower. This is especially true with Community Development Financial Institutions (CDFIs). CDFIs tend to take a ‘community approach’ to lending and their loan volume and customer base may not justify the frequent use of many technology solutions in the market. Small businesses are very disparate; with many not having organized financial records that fit into an automated underwriting model.

Herein lies a problem; to what extent should CDFIs utilize technology for underwriting? Should CDFIs implement full automation, half-and-half or white glove? Well, it really depends on the organization’s objective, business model and customer base. A good rule of thumb is to use different solutions for different problems. A Credit Union for instance may use a fully automated technology solution to underwrite credit card applications but choose to pair human underwriters with small business borrowers. Some lenders also farm out part of their underwriting work to third party companies. These third-party companies are underwriting consultants that review loan applications and underwrite the transaction so lenders can focus more on nurturing their client relationships and providing technical assistance. The consultant model is already popular in the mortgage industry and is gaining acceptance with Community Development Financial Institutions (CDFIs). Using underwriting consultants can help CDFIs close more loans by shoring up the capacity of their lending team. Another good reason for hiring third-party underwriters is that they are cost efficient. This is because they consultants get paid for hours worked and unlike employees, CDFIs tend to utilize them only when needed (usually during periods of increased workload). This doesn’t mean CDFIs should not hire their own in-house underwriters. It is however advisable to have different solutions for different problems. Think of the transportation industry. Most people drive their cars everyday but there may be instances when other forms of transportation are better suited. Perhaps taking the train when going to a baseball game downtown or boarding a plane when commuting to a different state. Gathering the right tools and knowing when best to use each one may be the key to maintaining efficiency and customer satisfaction for a lender.

Future

The future of underwriting is likely to involve a greater use of advanced technology and data analytics. With the increasing availability of data, CDFIs will be able to make more informed decisions. One example is using artificial intelligence (AI) and machine learning (ML) algorithms to analyze large amounts of data and make predictions about the likelihood of loan default. This may especially be useful in post-disbursement scenarios like portfolio management and recovery. Data-driven technology can help underwriters make more accurate risk assessments, which can result in more efficient and cost-effective underwriting. Telematics, already being used in the insurance industry can provide more accurate information about the behavior of borrowers and this can help make more accurate risk assessments; particularly in industries like agriculture and logistics.

While we all look forward to a more efficient world made possible by technology, there may be some roadblocks. For one, privacy laws may limit how certain data can be used in lending decisions. There is already widespread controversy in countries like China and parts of Africa where social credit scoring is being implemented by some lenders. Organizations like the Consumer Financial Protection Bureau will continue to fight for the rights of borrowers and how their personal data is being exploited. What alternative credit data will be used in the future? How receptive will borrowers be? How quickly can we gain mass adoption? Will the pace of underwriting lead to bias or discrimination? How can we measure safety of artificial intelligence? Only time will tell.

Comments