Benefits of hiring an underwriting consultant

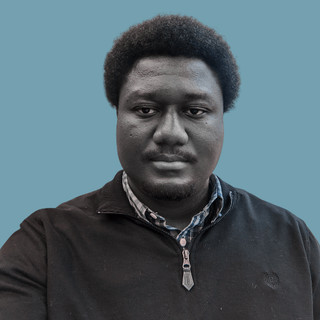

- Nosa Iyare

- Jan 19, 2023

- 2 min read

Updated: Aug 9, 2023

Community Development Financial Institutions (CDFIs) play a vital role in providing access to capital and financial services for underserved and underbanked communities. However, the process of underwriting loans can be complex and challenging for CDFIs, especially for those with limited resources or experience. This is where underwriting consultants can be of great help.

Here are some benefits of engaging an underwriting consultant

Expertise and Experience: Underwriting consultants bring a wealth of expertise and experience to the table. They have a deep understanding of the underwriting process and can help CDFIs navigate the complexities and nuances of loan underwriting. This can help CDFIs to make better-informed decisions and reduce the risk of loan defaults.

Capacity: It is difficult to anticipate the number of employees needed year-round to keep the loan pipeline moving. Multiple employees may quit at the same time. Some employees may be forced to take maternity leave or a leave of absence suddenly. There are also instances of a sudden influx of new loan applications. Underwriting consultants can help shore up capacity during these situations.

Cost-effective: Hiring underwriting consultants can be more cost-effective than hiring full-time staff, especially for small and medium-sized CDFIs. Consultants can be hired on a project basis, which can help CDFIs to keep costs down while still receiving the benefits of expert underwriting support.

Efficiency: Underwriting consultants can help CDFIs to streamline their underwriting process, making it more efficient and effective. This can help CDFIs to process loans more quickly and make decisions more efficiently, which can ultimately help to improve their bottom line.

Professional Development: Hiring underwriting consultants can help CDFIs staff to develop new skills and gain knowledge in the loan underwriting process. This can help CDFIs to build a stronger team and improve overall operations.

In conclusion, hiring underwriting consultants can be beneficial for CDFIs, as they bring expertise, experience, and compliance to the process; helping CDFIs close more loans and reduce the risk of defaults. There is very little risk with hiring a consultant as most consultants are paid per hour or per project. You engage them when you need them and there is no long-term commitment to using their services.

Comments