My 20-year prediction for the CDFI industry

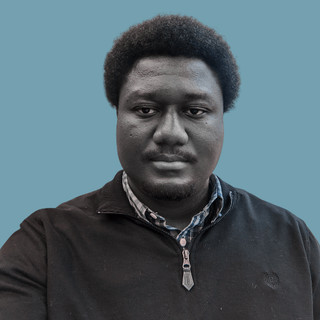

- Nosa Iyare

- Sep 14, 2025

- 10 min read

As I reflect on Overwrite’s progress since 2022, I am reminded that the work of community finance is measured not only in dollars deployed but in the lives, businesses, and communities strengthened along the way. In just a few short years, we have partnered with 14 clients to underwrite more than 200 loans and provided 400 hours of technical assistance. These milestones underscore both the trust placed in us and the resilience of the clients/entrepreneurs we serve. Yet these achievements are only part of a larger story. It provides an opportunity to pause, reflect, and look ahead, not only at our path, but where the CDFI industry as a whole is headed. The CDFI industry stands at an inflection point, shaped by decades of innovation and advocacy, and is now poised for a period of profound transformation. In the following article, I share a forward-looking perspective on where I believe the industry is headed over the next two decades.

A brief history of the CDFI Industry

CDFI roots stretch back to the civil rights and community empowerment movements of the 1960s and 1970s, when communities excluded from mainstream finance began building their own solutions. Prior to the 1970s, many banks would not provide lending products and financial services to low and moderate-income (LMI) neighborhoods, in a practice known as ‘redlining’. Redlined neighborhoods were considered “hazardous” areas and were the highest risk due to concentrations of residents of color, lower household incomes, and older housing stock. To address growing calls from community advocacy organizations for solutions to combat these disparities, Congress passed the Community Reinvestment Act, commonly known as the CRA, in 1977 (as part of the Housing and Community Development Act). The CRA requires federal banking regulators to encourage financial depository institutions, defined as banks and thrifts, to help meet the credit needs of the communities where they operate, including low- and moderate-income (LMI) neighborhoods. Alongside the CRA, a series of what became known as the Fair Lending Laws also passed during the late 1960s and 1970s and were intended to expand access to credit by prohibiting specific racial, gender, and other forms of discrimination in residential real estate, banking services, and credit transactions.

In 1994, the Riegle Community Development and Regulatory Improvement Act created the CDFI Fund within the U.S. Department of the Treasury, marking a turning point for formal recognition and support. It should be noted that the CDFI Fund represented a radical shift in how federal programs worked. Up until the formation of the CDFI Fund, federal programs disbursed funding directly to and solely for specific projects. Instead of supporting specific programs, the CDFI Fund was structured to assess and invest in skilled intermediaries (CDFIs), allowing each CDFI to use federal funding to build its balance sheet, support its operational capacity, and invest in specific projects as each CDFI saw fit.

Over the years, visionary leaders shaped the industry’s growth, including:

Sister Corinne Florek and the Adrian Dominican Sisters

Ron Grzywinski and Mary Houghton, co-founders of Shore Bank

Chuck Matthei, Executive Director at the Institute for Community Economics

Senator Donald W. Riegle Jr and Senator Paul Sarbanes, who supported the CDFI Fund’s creation

President Bill Clinton, who signed the Community Development Banking and Financial Institutions Act of 1994 into law

Donna Gambrell, former and longest serving Director of the CDFI Fund

Mark Pinsky, former and longtime CEO of Opportunity Finance Network (OFN) and founding partner of CDFI Friendly America

Bill Bynum, founder of HOPE Credit Union and Hope Enterprise Corporation

Native CDFI leaders such as Elsie Meeks (First Nations Oweesta Corporation) and Tawney Brunsch (Lakota Funds), who expanded the movement’s reach and depth in tribal communities.

The industry today stands on the shoulders of these (and many other) folks. For a more detailed history of the CDFI industry, please follow this link to OFN CDFI 101: History of the CDFI Industry.

My predictions for the next 20 Years

While I am still early in my journey within the CDFI industry, I’ve had the privilege of working closely with lenders, consultants, funders, and community organizations across the country. These experiences have afforded me a front row seat to both the challenges and innovations shaping the field. Thus, I have recently started to form my own perspective on where the industry may be headed. Of course, these are not certainties, and I may very well be wrong in some areas, but based on what I’ve seen and heard, here are my predictions for how the CDFI industry could evolve over the next 20 years:

1. More consolidation

Anticipate more mergers, acquisitions, and partnerships as CDFIs seek the scale necessary to manage larger transactions and complex portfolios. Many more of the larger CDFIs may even go public, opening themselves to broader scrutiny and capital markets. Larger institutions will also serve as intermediaries, channeling resources and capital to smaller ones. This shift will create efficiencies but could also reshape the diversity of approaches within the sector.

2. Wall Street’s influence

As the CDFI industry becomes more formalized, private capital (most likely private debt funds) will increasingly view CDFIs as a distinct and profitable asset class. The development of a secondary market for CDFI loans will normalize, and institutional investors will pour in capital. Also, as CDFIs expand their participation in SBA programs, Wall Street’s influence will grow stronger. Alongside this, more fintech CDFIs will emerge, and transaction volume will increase across the board.

3. Mission-Driven activists as Guardians of the Industry

As consolidation and capital markets reshape the industry, some practitioners will fear mission drift. In response, activist leaders may form new coalitions or deepen involvement in existing groups to ensure accountability. They will focus on preserving the core mission of financial justice, keeping the sector centered on those excluded by traditional finance. The balance between scale and purpose will remain a defining tension. The network of younger CDFI professionals, such as the ‘Next Gen in Finance Justice’ group, made up largely of early-career leaders under 30, will also grow stronger. I believe this rising generation will play a vital role in supporting the sector’s longstanding leaders, helping to safeguard mission integrity as the sector continues to grow and evolve.

4. Expanding beyond term loans

The industry will diversify far beyond traditional term loans. Revenue-based financing (RBF) will grow as entrepreneurs seek flexible repayment tied to performance. Community venture capital, which invests in equity stakes for small businesses and cooperatives, will become more common, particularly for businesses not ready for mainstream VC. Employee Stock Ownership Plans (ESOPs) will become an exciting space that more CDFIs will participate in. Loan funds that once focused solely on debt will migrate toward offering multi-product financing tailored to borrower needs. Future CDFIs will operate as hybrid institutions, deploying grants, loans, equity, and revenue-sharing in combinations best suited to their communities. This blended approach will not only attract more diverse funders but also meet the evolving needs of borrowers. Capital will be seen less as a single tool and more as a versatile toolbox.

5. AI-Driven Technical Assistance and Underwriting

Artificial intelligence will transform both lending and technical assistance. AI-powered underwriting will make loan decisions faster and more accurate, while chatbot-driven support, virtual AI Agents, and AI Video Avatars will deliver technical assistance at scale. Clients will be able to access real-time, multilingual guidance through virtual call centers. While human oversight will remain essential, AI will enable CDFIs to serve a far greater number of borrowers with limited resources.

6. Harmonized Industry Standards

Over the next 20 years, CDFIs will move toward uniform accounting and reporting standards, similar to GAAP for public companies. This harmonization will make it easier for investors, regulators, and communities to compare performance across institutions. For CDFIs, this will reduce friction in reporting and make collaboration across the sector more efficient. The number of rating agencies active in the CDFI space may also increase, and this will deepen credibility with outside capital. As harmonized standards take hold, it will also become easier for staff to transition between CDFIs, bringing greater mobility across the industry. This increased fluidity will heighten competition for talent, pushing organizations to invest more in retention, professional development, and workplace culture. Professional certifications unique to the CDFI industry may also start to emerge.

7. International Expansion

CDFIs will increasingly expand beyond the United States. Initial efforts may begin with grant-funded initiatives, but lending and community programs will follow. In my opinion, the low hanging fruit is to expand to more American territories like Puerto Rico and Guam. However, Countries/Regions like Canada, Mexico, New Zealand, the Caribbean, India, and Sub-Saharan Africa offer natural entry points. Native CDFIs, with their experience in sovereignty-based finance, are well positioned to lead this international expansion, particularly in cross-border contexts in North America.

8. Complex Regulation

As the industry grows in size and complexity, CDFI certification will become more stringent. This will professionalize the sector but may create barriers for smaller or emerging CDFIs. States may also establish their own ‘mini-CDFI Funds’, tailoring resources and oversight to local needs. Regulatory evolution will bring both opportunity and challenge as the industry matures.

9. Rise of CDFI Support Organizations

Just as credit unions gave rise to Credit Union Support Organizations, CDFIs will likely see the emergence of member-owned support organizations that provide centralized administration, shared back-office services, and pooled resources. These groups will help smaller CDFIs achieve efficiency and scale without losing their local identity. In some cases, support organizations may rival traditional funders in influence, becoming critical parts of the ecosystem.

10. From Solo Consultants to full-service firms

Consulting around CDFIs will grow from individual practitioners into full-service consulting firms. These firms will provide compliance, outsourcing, capitalization, executive search, and many more services under one roof. Global players like Deloitte and PwC may also become more active in the space, following Wall Street capital into the industry. This shift will not only professionalize CDFI Consulting, but may also challenge smaller firms to specialize or merge.

11. Climate Finance’s reality check

Climate lending will expand beyond current levels, but will not dominate the industry as some predict. While CDFIs will finance solar projects, resilient housing, and green businesses, climate will be one of many missions and not the singular focus. Unfortunately, the industry’s ‘climate plans’ may not live up to the hype. The industry’s DNA will remain centered on inclusive economic opportunity, balancing environmental and social priorities.

12. A new role for the CDFI Fund

The CDFI Fund may evolve into a quasi-independent agency or even an independent regulator, overseeing certification and industry standards. States could follow suit by creating their own mini-CDFI Funds, building localized ecosystems. Many industry veterans may move into leadership roles within these state-level entities, expanding the reach of CDFI principles across government.

14. End of the Marketing Problem

Two decades from now, the CDFI industry will no longer struggle with recognition. Policymakers, investors, and the public will clearly understand what a CDFI is and how it differs from a bank. This clarity will make capital raising easier, strengthen partnerships, and reduce the need for explanation. The industry will finally be recognized at the scale its work deserves. CDFI names and brands will also evolve as CDFIs embrace broader recognition. Many institutions will drop the acronym-heavy or technical names in favor of shorter, marketable identities. This shift will make the sector more accessible to borrowers and investors alike. Branding will become a strategic tool, reflecting both mission and market positioning.

15. Integration with Health and Social Services

CDFIs will increasingly collaborate with hospitals, public health agencies, and social service organizations. By financing community clinics, housing linked to healthcare, and wellness initiatives, CDFIs will become integral to a broader ecosystem focused on “social determinants of health”. This shift will deepen their role in community well-being beyond traditional economic development.

16. Emphasis on Generational wealth creation

In the coming decades, CDFIs will place greater emphasis on helping families and communities build generational wealth (moving beyond access to credit alone). As the United States enters the era of the ‘Great Wealth Transfer’ with trillions of dollars shifting from Baby Boomers to younger generations, CDFIs will focus more on wealth-building strategies for families and communities. Products like homeownership support, small business equity stakes, financing business acquisitions, and cooperative investment vehicles will help families build multi-generational assets. At the same time, immigrants who already start businesses at higher rates than native-born Americans will increasingly rely on CDFIs rather than traditional banks. This will align with rising trends in entrepreneurship through acquisitions (ETA), where younger entrepreneurs purchase and grow existing businesses as a pathway to ownership. Together, these forces will push CDFIs to expand beyond access-to-credit models and into more holistic wealth-building strategies that shape communities for generations.

17. Cross-Sector CDFIs

In the future, CDFIs may not fit neatly into today’s categories of loan funds, banks, venture capital, or credit unions. We’ll see cross-sector CDFIs that combine multiple charters or licenses, enabling them to offer banking-like services, investment products, and development financing under one umbrella. These hybrid organizations will blur traditional lines but will also expand flexibility in serving community needs.

18. Stronger partnerships with Corporations

While Philanthropic and Impact Investment Organizations are already a mainstay in the CDFI industry, corporations will become more involved (particularly B Corps). Corporations will move beyond one-time commitments to long-term strategic partnerships with CDFIs. Instead of episodic funding bursts (like those seen during the COVID-19 pandemic), companies will embed CDFIs into their ongoing equity, ESG, and community investment strategies. This will create more predictable flows of capital and deepen CDFIs’ role as trusted intermediaries between private wealth and community needs. I wonder if there’ll come a time when a major corporation pledges a small percentage of its annual profits to support CDFIs.

19. Greater role in Housing and Real Estate Finance

Over the next two decades, CDFIs will become increasingly central to affordable housing and community real estate development. With housing shortages worsening nationwide, CDFIs will step in where traditional lenders are hesitant, financing a range of projects, from small-scale affordable housing developments to mixed-use community projects. Although CDFIs already do this now, the increased activity in the space will position CDFIs as not just lenders, but as community developers, shaping how neighborhoods grow and evolve.

20. Deeper partnerships with Local Governments

Municipalities and counties will increasingly rely on CDFIs as their preferred partners for community lending, small business relief programs, and affordable housing initiatives. CDFIs will become embedded in local economic development strategies, managing city-backed revolving loan funds and delivering targeted programs. There may also start to be regular allocations to CDFIs within state and municipal budgets. These partnerships will make CDFIs indispensable extensions of local government infrastructure.

About Overwrite

Overwrite is an economic development consultancy that provides outsourced loan underwriting, technical assistance, and consulting services to Community Development Financial Institutions (CDFIs) and Economic Development Organizations. Inquiries: info@overwriteinc.com

Comments